The United States government spends over 60% of its federal budget on transfer payments. Transfer payments are those that are generated from taxpayers that the government routes directly to individuals. Welfare, social security, food stamps and other payments directly to citizens or refugees are included among transfer payments. Transfer payments are the major drivers of the government budget and of the national debt.

President Lyndon Baines Johnson added to Franklin Roosevelt’s Social Security program by essentially expanding it to all Americans in the 1960’s under the Great Society platform. Furthering the welfare trend, President Joe Biden offered to cancel (e.g have the taxpayer pay for) student loans for those attending college. Today, there are 100 million people who receive government transfer payments, or about 1 person in 3. One way this could be interpreted is that 2 people are working and are paying the benefits that the 3rd is receiving. Yet this is an oversimplification.

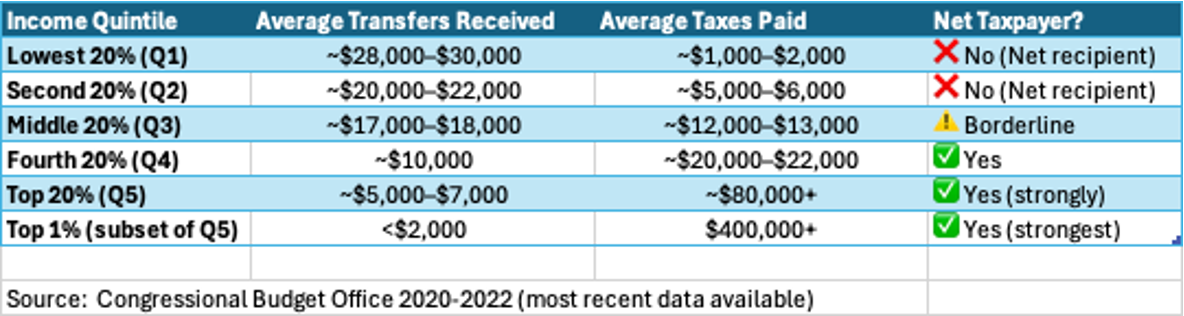

If we look at the incomes, government transfer payments and taxes paid, we can see who pays the taxes and who receives. In fact, only 40% of Americans pay net taxes (taxes paid minus transfers received) so that 60% of Americans can receive payments from the government. It is true that some taxes paid are for services and products the government actually provides for the country: block grants for roads, national defense, environmental regulation, law enforcement, etc. These government activities are useful to all Americans and represent about 40% of government spending that currently ranges from $6 - $7 trillion annually.

Transfer payments represent about 55% of government spending (the 5% difference approximates the interest payments on the debt our government has borrowed). Therefore, the above table is indicative of 55% of $7 trillion in spending (revenue + borrowing). Directionally, this financial situation gets worse over time. While it used to be the middle class (quintile 3) were net payers, increasingly fewer are.

Transfer payments, largely supported by Democrats, are divisive. They have the effect, intentional or not, of dividing the country. The fifth quintile are wondering when the first quintile are going to be personally financially responsible - improve their earning capability and ambition. Likewise, they think the first quintile have it easy because they get money without having to earn it.

The first quintile have issues with the fifth quintile as well. Stoked by Democrats, the common language of the first quintile is that the fifth quintile does not pay their “fair share” of taxes and are thus are failing to contribute to the system. Their disdain of income inequality presupposes that the natural state of affairs is income equality, something that is nonsensical.

This is perhaps the most divisive idea of our time. Welfare based transfer payments require the productive and hard working to pay for those who have low productivity because they are less skilled or lack ambition. This amounts to a collective justice point of view, where society is culpable for individual challenges and must provide restitution as a result.

In response, a justice oriented question should be asked: what did a millionaire or billionaire actually do to cause people who live on the other side of the nation to use drugs, abuse alcohol or otherwise not be able to secure steady employment? Did a rich man in North Carolina force a man in Iowa to drop out of high school? Is it true that a Silicon Valley billionaire sold alcohol to the woman on Long Island and made her an alcoholic unable to hold a job? If the answer to these questions is in the negative, then why are they responsible for “transferring” money to them, thus paying restitution?

Governments subsidize something they want to increase, while taxing something they want to curb. Many governments, including the U.S., tax tobacco products to reduce its use. Likewise, governments subsidize college research and attendance for faculty and students respectively, because they want to drive innovation and education. In the case of welfare, it seems strange that the government would want more poverty (subsidies), less working and earned income (taxes). Irrespective of the intent, that is the effect.

It makes sense to want to eradicate abject poverty in the United States. However, throwing money at the problem does not seem to work, as the federal government has spent just over $82 trillion on poverty oriented transfer payments since their inception. That is 2.2 times the entire federal debt of which transfer payments are a major driver. Collective justice, while costly, does not seem to eliminate poverty. It isn’t even clear that Democrats want to anyway, since nearly 60% of low income people affiliate with them. Eliminating poverty and sacrificing a dedicated voting block would be political suicide, and so the welfare wheel keeps turning.

Welfare and related policies represent the most divisive on the books. The poor demand more money from the successful. Those with means wonder why the poor have not followed their example and built their own lives responsibly. Moreover, the insidious acceptance of transfer payments yields more transfer payments, such as corporate and student bailouts, due to omnipresent issue of precedent.

The rise of collective justice actually distracts from actual justice, the only way poverty in the United State or any country can actually be alleviated. All of us care about reducing poverty generally, but that should not imply culpability Pitting earners against non-earners does not solve anything, except to preserve voting blocks for political parties.

This is my favorite article because it is the one issue that angers me the most. Most of us who are paying in, as in writing a huge check to the government once a year, could really use that money. We aren't over here going to the spa once a week. Sure, there are those, but that's not the bulk. And, yes, there are ways around sending it to the government, but you can only afford so many payments and write-offs before payroll comes and you have to pay the workers. It's tacky to talk about money, but the check we wrote this year was a six-figure number. We aren't wealthy. I don't think employees understand that you don't get to keep everything you make as an owner.

Michael, what a fantastic article that truly explains in simple yet understandable terms…bravo!🇺🇸🫡